Facts About Public Insurance Adjuster Revealed

Table of ContentsSome Known Factual Statements About Public Adjuster Nj Examine This Report on Public Adjuster7 Simple Techniques For Public Insurance Adjuster

A public adjuster is an expert cases handler/ cases insurance adjuster that supports for the insurance policy holder in evaluating as well as negotiating a complaintant's insurance claim. Apart from lawyers and also the broker of record, state certified public insurers can legitimately represent the legal rights of an insured throughout an insurance claim process. Their technical knowledge as well as capability to translate often uncertain insurance coverage policies allow homeowner to get the optimum amount of indemnification for their insurance claims.Lots of specialists, as well as individuals that are either unable because of education, age, or physical disability, choose public adjuster depiction to guide them via the procedure as well as reduce the time which has to be spent to excellent their case. The majority of public adjusters bill a portion of the settlement. Mostly public insurance adjusters review your insurance plan to identify if there is protection for the loss, evaluate the root cause of loss which will certainly set off coverage, prepare detailed extent as well as expense estimates many times utilizing experts in the areas of removal, toxicology, and also building engineers to confirm their loss.

Outside the United States insurers are frequently called (or translated right into English as) "insurance loss assessors" (or merely "loss assessors") and also personnel insurers or independent insurance adjusters are called or translated as "insurance coverage loss adjusters" (or merely "loss insurance adjusters"). Nonetheless, there is a clear distinction between a loss insurer, who services behalf of an insurance company, as well as a loss assessor that services behalf of a policyholder.

The states that do not are: Alaska, South Dakota, as well as Wisconsin. In enhancement, it is necessary to keep in mind that on October 14, 2005, the National Organization of Insurance Commissioners (NAIC) adopted the Public Adjuster Licensing Version Act (MDL-228), which governs the certifications as well as treatments for the licensing of public insurers - Public Adjuster NJ.

The Definitive Guide for Public Insurance Adjuster

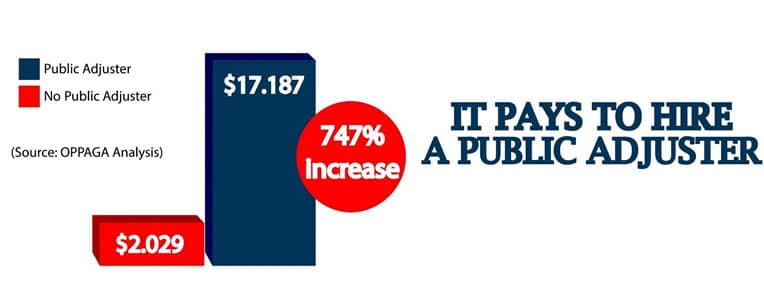

The worry of presenting a specialist insurance claim to an insurance company can be relieved by the job of a public insurer. Plan holders that are not appropriately compensated by their insurance service providers might be entrusted little choice yet to work with specialist help to recuperate the insurance claim settlement to which they are qualified.

The daily meanings of terms like "collapse", "partial collapse" and "degree of physical damages" could be totally different from their lawful analyses, requiring the insurer to clarify such terms for the customer. Regulations pertaining to the usages of these terms are frequently in a state of change so it is very important for public insurers to have a solid grasp of the legislation consisting of the division of legal duties in between insurer and also insurance policy holders.

For instance, one Georgia business states their average fee is 20% based on the kind and also amount of the insurance claim [citation required] Nonetheless, lower percents are used for bigger losses being claimed under a plan of insurance. Higher percents are needed for smaller sized claimed losses. Smaller sized insurance claims can have comparable costs as larger cases, but due to the fact that the recuperation is less on smaller insurance claims the cost range should be adjusted to make up for the operating expense.

The Only Guide for Public Insurance Adjuster

Abilities of efficiency can vary significantly between public insurance adjusters varying from fundamental to elite professional. Public over here Insurance Adjuster. Costs of 15% to 20% are common and also common for claimed losses of $100,000 or better when handled by standard-rated public adjusters. Expert-rated public insurers get a greater cost than standard-rated adjusters. For example, an experienced public insurer can bill 18% to 20%+ on a loss that surpasses $100,000.

Some public insurers bill a flat percentage or a flat fee set cost, while others utilize a regressive range. It depends, in component, on the State Law where the loss happened. For example, a regressive scale can be 25% of the first $100,000, 20% between $100,001 and $200,000, and also 15% of any amount past that.